More American Are Buying Home Again

The American dream of homeownership has not been dampened by the COVID-19 pandemic and the economical downturn it has caused.

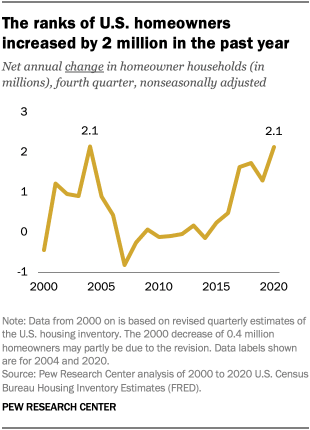

In the fourth quarter of 2020 in that location were an estimated 82.8 million owner-occupied households in the U.s.a., according to recently released Demography Bureau information. The number of homeowners increased by an estimated ii.1 one thousand thousand over the prior twelvemonth. Based on 4th-quarter nonseasonally adjusted information, this matches the largest prior net increase in homeowners that occurred during the housing boom between 2003 and 2004 (two.1 million).

After falling in the immediate aftermath of the coronavirus outbreak, sales of existing homes in the U.S. accept bounced back, and almanac sales reached their highest level since 2006. The robust activity in residential real estate raises questions virtually whether the pandemic is associated with an expansion of homeownership.

Counts of occupied housing units and homeowners are from the Electric current Population Survey/Housing Vacancy Survey. This survey is not the only Census Bureau survey providing estimates of the home buying rate, but it is the but i generating estimates on a quarterly, as opposed to annual, basis. The number of homeowners and homeownership rates employ the revised estimates from the second quarter of 2000 forward. The bureau has not issued revised estimates for quarters before the second quarter of 2000.

The coronavirus pandemic has impacted the homeownership data collection during 2020. Households are in the survey sample for a total of eight months. They are interviewed in person twice. The Census Bureau suspended all in-person interviews from March 2020 until June 2020. In lieu of in-person interviews, the agency tried to conduct telephone interviews. Personal interviewing was resumed first in July in certain areas of the country and by September was viable throughout the state. For Nov and December, in-person interviewing was suspended for some areas. Every bit a outcome, response rates to the survey have been lower than before the pandemic. The response rates for Oct, Nov and Dec 2020 were 81%, 80% and 77%, respectively. The boilerplate response charge per unit for the same months of 2019 was 84%.

The changes in data collection procedures could accept impacted estimates of the homeownership rate for the 4th quarter of 2020. Based on the full sample, the homeownership rate increased 0.7 pct points compared with a yr earlier. The Demography Bureau released supplemental estimates for the fourth quarter of 2019 and 2020 where the sample was limited to geographies where in-person interviews were permitted in the fourth quarter of 2020. On this basis the estimated homeownership rate increased 0.4 points.

The estimates of 2019 median adapted household income were derived from the 2020 Current Population Survey, Annual Social and Economical Supplements (ASEC). The ASEC microdata files were provided by the IPUMS at the University of Minnesota. The estimates are in 2019 dollars and scaled to reflect a three-person household.

Some of the growth in homeownership is owing to overall growth in the economy and in the number of households in the U.Southward. over fourth dimension. The addition of 2.1 one thousand thousand homeowners in 2020 represents an annual increase of 2.6%. This is the seventh largest percentage increase in homeowners dating back to 1965.

A substantial amount of the increase in homeowners has occurred since the onset of the coronavirus outbreak in Feb. The net number of homeowners is upwardly 1.6 one thousand thousand since the first quarter of 2020.

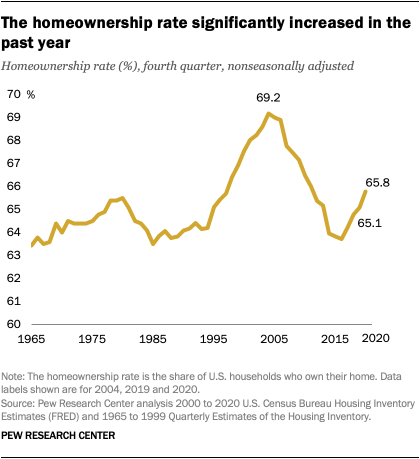

Peradventure non surprisingly, the boom in the number of homeowners as well boosted the homeownership rate. As of the fourth quarter of 2020, 65.viii% of households own their homes, upwards from 65.1% a year earlier. This 0.7 percentage signal increase in the homeownership rate is not the largest on record (the charge per unit increased 0.ix points from 1994 to 1995), simply it is large nonetheless.

The 2020 homeownership rate remains below the historical peak of 69.two% in 2004. Dating dorsum to 1965, the homeownership rate has averaged 65.3% (based on 4th-quarter information).

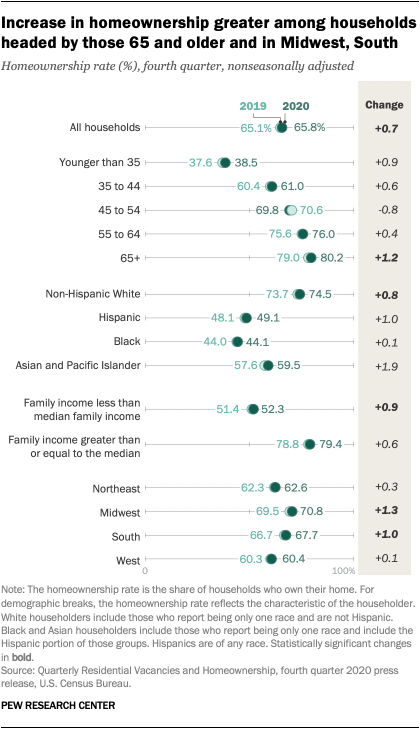

The increment in the homeownership rate over the past year has been more pronounced among some demographic groups. Information technology rose 1.2 percentage points for households headed by someone historic period 65 or older. At the same time, the change in rate amidst householders in younger age groups was not statistically meaning.

Homeownership among households with a White householder rose an estimated 0.8 percentage points from 2019 to 2020. But the rates for heads of household of another race or ethnicity remain significantly below the White homeownership rate and did not significantly increase. The Asian homeownership charge per unit now stands at 59.5%; the Hispanic rate is 49.ane%. The rate for households headed by a Black householder is 44.ane%, well off the peak of 49.4% in 2003.

The increase in the homeownership rate from 2019 to 2020 was more substantial for households with family incomes below the national median. The charge per unit rose 0.ix pct point for these households, compared with a 0.vi-point increase for more affluent households (the latter non being statistically pregnant).

Homeownership rates go along to be higher in the Midwest and S compared with the Northeast and West. Homeownership rose at least a per centum signal in the Midwest and South but was statistically unchanged in the Northeast and West.

The smash in homeownership has occurred during a time that has brought financial challenges for many Americans. In that location were steep job losses in 2020 due to the pandemic, only they brutal virtually heavily on young adults and workers in low-wage occupations. Both of these groups are less likely to be prospective dwelling buyers. The New York Federal Reserve institute the median credit score of first-fourth dimension mortgage borrowers in 2020 was nearly 740. A credit score of 700 or above is generally considered good, and the median for 2020 was "more prime" than ever dating back to 2002.

At the aforementioned fourth dimension, interest rates were at record lows in 2020, making it easier for those who were in the marketplace for a home to take that step.

In addition, household incomes were at a record loftier before the onset of the pandemic. The median adjusted household income was about $80,700 in 2019, up from $76,000 in 2018. And household incomes were at records for most age groups.

Finally, the net increment in homeowners reflects a slowdown in foreclosures. Prior to the pandemic, the foreclosure rate was far below its 2010 peak. While the recession has made it more than hard for some homeowners to stay current on their mortgage payments, the foreclosure moratoriums have thus far prevented many homeowners from losing their homes.

Richard Fry is a senior researcher focusing on economics and education at Pew Research Center.

Source: https://www.pewresearch.org/fact-tank/2021/03/08/amid-a-pandemic-and-a-recession-americans-go-on-a-near-record-homebuying-spree/

0 Response to "More American Are Buying Home Again"

Post a Comment